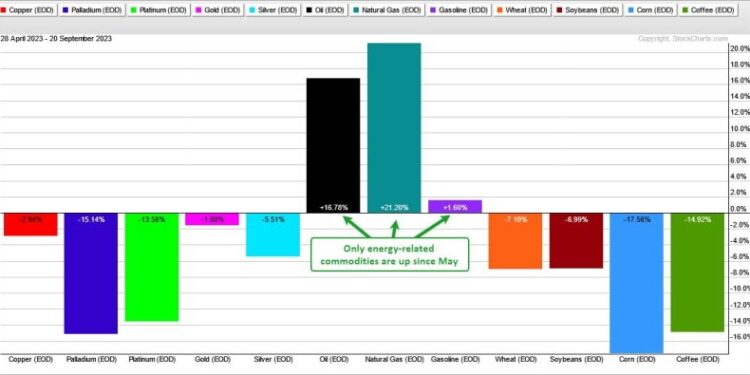

Recently, commodity markets have been experiencing a shift towards energy-related commodities as increasing demand and tight supply lead to sharp increases in prices. This shift is driven by a number of factors, including growing demand from emerging economies and the drop in oil production due to geopolitical tensions. Consequently, energy-related commodities such as natural gas, coal, copper, and uranium have seen significant gains in value over the past few months. However, while these commodities appear to be on the rise, it appears that oil may be vulnerable in the near future.

Oil has been the cornerstone of the global economy, and its price had held firm over the past few years. However, in recent months, this has begun to change, with the price dropping significantly. This is due to a range of factors, including increased US crude oil production and the OPEC/ non-OPEC countries production-cut agreement, which has reduced the global demand for oil. Additionally, the rise of renewable energies, such as solar and wind, have made oil increasingly less attractive for energy production. Therefore, while energy-related commodities continue to experience bullish runs, it appears that oil may be set for a period of sustained vulnerability in the short term.

Analysts predict that although the price of oil may remain low in the near future, it could rebound in the long-term if global tensions ease and demand for energy recovers. Nevertheless, it is clear that energy-related commodities are set to remain the primary drivers of the commodity market in the near future. This is likely to have positive effects on the global economy, particularly given the potential for job creation in the industry. Moreover, it is also likely to bring about greater investment opportunities, as commodity traders look to capitalize on the bullish market conditions.