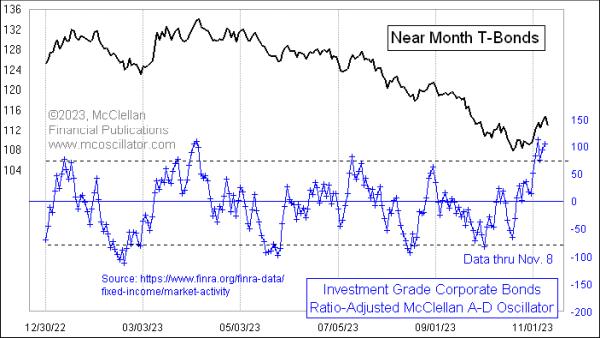

The McClellan Oscillator, developed by Sherman and Marian McClellan, is a technical analysis tool used to gauge the direction of the investment-grade bond market. It compares the net advancement of investment-grade bonds against the total number of advances, and divides that difference by the total number of advances plus declines. The McClellan Oscillator paints a clearer picture of the bond market’s direction, providing investors with the ability to make timely, informed decisions when analyzing investment-grade bonds.

The formula for the McClellan Oscillator is the following:

McClellan Oscillator = [(Advances – Declines)/ (Advances + Declines)] * 100

The McClellan Oscillator helps investors see potential entry or exit points for investment-grade bonds. When the oscillator is increasing, it is an indication of an uptrend in the bond market. Conversely, when the oscillator is decreasing, it reveals a potential downtrend. If investors see the oscillator hovering around the zero line, it might indicate consolidation or a sideways movement in the market.

The McClellan Oscillator is also a great tool for traders looking to invest in investment-grade bonds over a short trading timeframe since it can detect short-term trends. The data the oscillator provides makes it easier for investors to determine when to buy and sell investment-grade bonds to maximize profits.

To sum up, the McClellan Oscillator is an effective tool to identify potential entry and exit points in the investment-grade bond market. It helps investors understand potential trends and make sound, timely decisions regarding their investments.