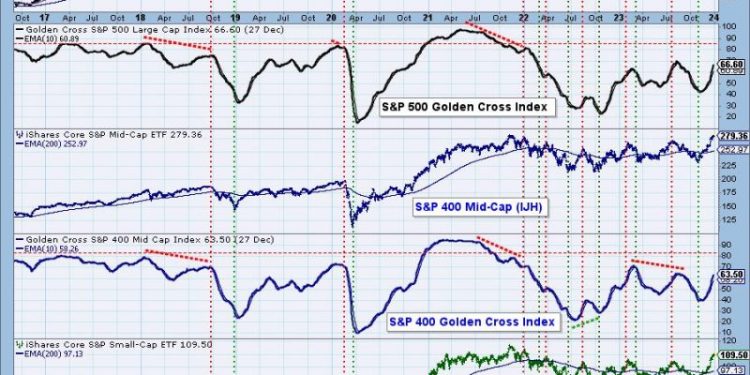

Intermediate-term participation levels are a measure of investor sentiment and activity in the marketplace. Currently, they are showing immense strength in a short amount of time, leading many experts to believe that the market may be overextended. However, when looking at the longer-term picture, these participation levels may be weak and out of sync with true fundamentals of the stocks and businesses that make up the market.

Investors often feel optimistic about the markets during times where overall participation levels are high. However, this may lead those same investors to buy up stocks too quickly and at too high of prices. Such buying can be interpreted as a sign of over-participation and market misallocation. The recent surge in participation levels may mean that investors are over-investing in stocks, leading to overvaluation and a weak long-term outlook.

In contrast, low intermediate-term participation levels indicate that investors are exercising caution in buying and selling stocks. As a result, individual assets in the market may be slightly undervalued, creating opportunities for savvy investors to scoop up these stocks at slightly discounted prices as everyone else takes a step back. In theory, these lower participations levels combined with the longer-term outlook can create more opportunities for savvy investors, whether it’s through discounted prices or smaller cap stocks that may have higher growth potential.

In conclusion, evaluating intermediate-term participation levels can help investors understand the current sentiment and activity in the market, giving them a better understanding of the overall environment and trends. At present, participation levels may be high and weak in the long-term, meaning investors should be cautious about investing and monitor the market for any changes in sentiment. However, lower participations levels can provide opportunities for those looking to capitalize on discounted prices or find stocks with high growth potential.