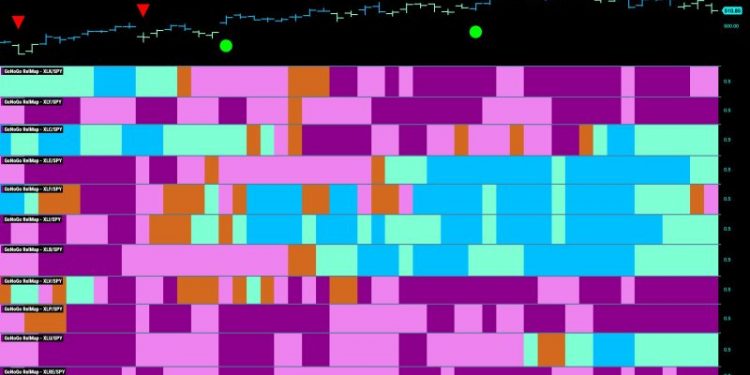

Equity markets have been facing a challenging environment as they struggle to retain their Go trend, with industrials attempting to take the lead. The dynamics at play have created a sense of uncertainty among investors, influencing the performance of various sectors within the equity markets.

The industrial sector has emerged as a focal point in this struggle for sustainability. Traditionally seen as a barometer of economic activity, industrials hold significant weight in determining the overall health of the equity markets. However, recent fluctuations in this sector have raised concerns about the broader market outlook. The performance of industrial giants, such as conglomerates and manufacturers, is closely watched by investors for signals about the economy’s strength and direction.

Technological advancements have also played a role in shaping the equity markets’ current landscape. Disruptive innovations, such as artificial intelligence, automation, and blockchain technology, have redefined traditional business models and created new opportunities for growth. Companies that successfully navigate these changes stand to benefit, while others risk being left behind.

Moreover, geopolitical factors have added another layer of complexity to the market dynamics. Ongoing trade tensions, political unrest, and regulatory challenges have created a challenging environment for investors to navigate. The interconnected nature of global markets means that developments in one part of the world can have far-reaching implications for investments elsewhere.

The impact of environmental, social, and governance (ESG) considerations on equity markets cannot be overlooked. Investors are increasingly prioritizing sustainability and ethical practices in their investment decisions, prompting companies to enhance their ESG disclosures and practices. Companies that fail to meet these standards may face repercussions in terms of investor confidence and market performance.

Amidst these challenges, opportunities for growth and innovation persist within the equity markets. Emerging industries, such as renewable energy, cybersecurity, and biotechnology, present new avenues for investors to diversify their portfolios and capitalize on evolving trends. The ability to identify and capitalize on these opportunities will be crucial for navigating the current market environment successfully.

In conclusion, the struggle to maintain the Go trend in equity markets while industrials vie for leadership underscores the complexities and uncertainties inherent in investing. As market participants navigate these challenges, a keen understanding of sector dynamics, technological developments, geopolitical factors, and ESG considerations will be essential for making informed investment decisions. By staying informed, vigilant, and adaptable, investors can position themselves to capitalize on opportunities and mitigate risks in an ever-evolving market landscape.