Nuclear Fuels Corporation (NFC) is excited to announce that it has finalized a bought deal private placement for the purchase of 5 million common shares in the company. NFC is a global leader in the production of high-grade fuel for nuclear power plants, and is committed to providing clean and sustainable nuclear energy. This private placement will enable NFC to accelerate its growth and continue to deliver innovative nuclear energy solutions.

The 5 million common shares purchased represent a total investment of approximately $142 million by the purchasers. The purchased shares are expected to be purchased through a combination of short-term loans and equity contributions from the lead purchaser, at a price of $21.80 per common share. The additional capital raised will be used to fund the company’s long term growth strategy, which includes the expansion of its nuclear fuel production facilities, as well as research and development.

NFC has been in business for over 25 years, and is the leading supplier of nuclear fuel to the world’s nuclear power plants. It is an important player in the global energy landscape, providing safe, clean, and reliable nuclear energy to power communities around the world. By securing additional capital, NFC will be able to continue its important work of advancing nuclear energy production solutions.

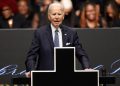

NFC CEO, Josh Rush, commented, “We are thrilled to announce this private placement, which will enable us to expand our nuclear fuel production capabilities and invest further in research and development. We are confident that this investment will ensure that NFC continues to deliver reliable and clean nuclear energy to our customers and to the global community.”

NFC is committed to providing safe and clean nuclear energy, and this private placement is another demonstration of the company’s commitment to the future of nuclear energy. With this additional capital, NFC will be better positioned to continue to meet the world’s nuclear energy needs.