Part 6: Is Volatility Risk?

In the world of finance, volatility is often seen as a measure of risk. But is volatility really a valid indicator of risk? This question has sparked much debate among investors and scholars alike. In this sixth installment of our series on the hoax of modern finance, we delve into the concept of volatility risk and explore its limitations and implications.

Volatility refers to the degree of variation or fluctuations in the price of a financial instrument over time. It is commonly measured using statistical tools such as standard deviation. The prevailing belief is that higher volatility indicates higher risk, as price swings may lead to losses for investors.

However, this notion oversimplifies the complex nature of market dynamics. Volatility alone does not tell us anything about the direction of price movements or the probability of these movements occurring. It merely quantifies the level of price fluctuations without distinguishing between positive or negative changes.

Additionally, volatility tends to be mean-reverting, which means that extreme volatility is often followed by periods of lower volatility. This poses a challenge for investors who rely solely on volatility as an indicator of risk. Market conditions can shift rapidly, making it difficult to predict future fluctuations based solely on historical volatility levels.

Moreover, volatility can conceal hidden risks. A low-volatility environment can create a false sense of security, as investors may underestimate the potential for sudden and significant price movements. Conversely, a high-volatility environment can present opportunities for astute investors to profit from sharp price swings.

The problem with solely attributing risk to volatility lies in the assumptions made by traditional finance models. Many financial models assume that asset prices follow a normal distribution, commonly known as the bell curve. However, empirical evidence suggests that financial markets exhibit fat-tailed distributions, meaning that extreme events occur more frequently than predicted by the normal distribution.

By assuming a normal distribution, traditional models fail to capture the true nature of risk and the potential for extreme events. This flaw becomes particularly apparent during times of market turmoil, such as the 2008 financial crisis. High-volatility events, termed black swans by Nassim Nicholas Taleb, can have far-reaching consequences that traditional models fail to account for.

As financial markets become increasingly complex and interconnected, the risk landscape evolves. Volatility alone cannot capture the multitude of factors that contribute to risk. A comprehensive risk management framework should incorporate a broader set of risk metrics, including correlation, liquidity, leverage, and tail risks.

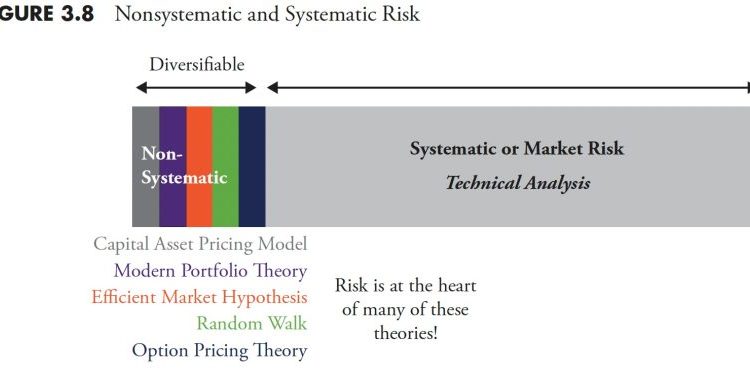

Investors should also consider the principle of diversification, which aims to spread investment across different asset classes and regions. Diversification helps mitigate the impact of volatility in individual assets or markets, as losses in one area may be offset by gains in another.

In conclusion, while volatility can provide insights into price fluctuations, it is an incomplete measure of risk. Relying solely on volatility as an indicator of risk can lead to misguided investment decisions. To navigate the complex landscape of modern finance, investors should embrace a holistic risk management approach that integrates various risk metrics and remains adaptable to changing market conditions.