Market Research and Analysis – Part 1: Why Technical Analysis?

Technical analysis is a vital component of market research and analysis that focuses on analyzing historical price and volume data to predict future price movements. Traders and investors use technical analysis to make informed decisions based on patterns, trends, and market indicators. This article delves into the importance of technical analysis in understanding market dynamics and making sound investment choices.

Understanding Market Sentiment

Technical analysis plays a crucial role in understanding market sentiment. By studying historical price movements and volumes, analysts can identify patterns and trends that reflect the collective psychology of market participants. These patterns can indicate whether the market sentiment is bullish, bearish, or neutral, helping traders anticipate potential price movements.

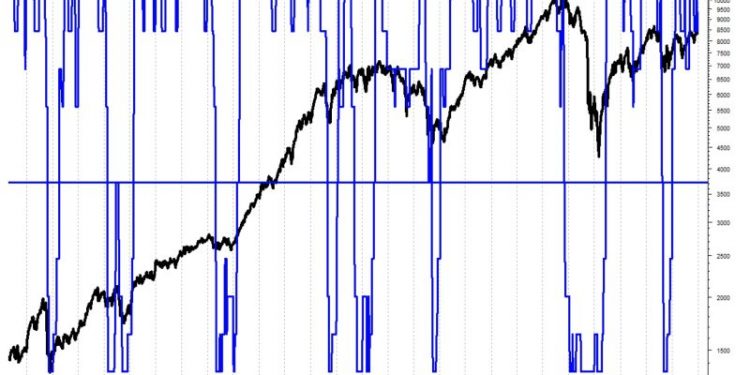

Identifying Trends and Patterns

One of the key benefits of technical analysis is its ability to identify trends and patterns in the market. By analyzing historical price data, technical analysts can identify support and resistance levels, trend lines, and chart patterns that provide valuable insights into potential future price movements. This information is instrumental in developing trading strategies and making informed investment decisions.

Utilizing Technical Indicators

Technical analysis involves the use of various technical indicators to analyze price data and generate trading signals. These indicators include moving averages, relative strength index (RSI), stochastic oscillators, and many others. By interpreting these indicators, traders can gain valuable insights into market dynamics and make informed decisions about when to buy or sell assets.

Predicting Price Movements

Another significant benefit of technical analysis is its ability to predict future price movements. By analyzing price charts and patterns, technical analysts can make educated guesses about where prices may be headed next. While technical analysis does not offer foolproof predictions, it can provide traders with a framework for making informed decisions based on historical data and statistical probabilities.

Risk Management

Technical analysis also plays a crucial role in risk management. By identifying key support and resistance levels, traders can set stop-loss orders to limit potential losses and protect their capital. Technical analysis helps traders establish risk-reward ratios and determine optimal entry and exit points, enhancing their ability to manage risk effectively in the market.

In conclusion, technical analysis is an indispensable tool for traders and investors looking to understand market dynamics and make informed decisions. By studying historical price data, identifying trends and patterns, utilizing technical indicators, predicting price movements, and managing risk effectively, traders can enhance their trading strategies and improve their overall success in the market. In part 2 of this series, we will delve further into the practical application of technical analysis in market research and analysis.