House Judiciary Committee Democrats have announced they are probing the FBI over whether Director Kash Patel is willfully refusing to disclose information related to Jeffrey Epstein.

‘Who exactly are you protecting by refusing to release the Epstein files? In 2023, on Benny Johnson’s podcast, you were asked why the Federal Bureau of Investigation (FBI) was ‘protecting the world’s foremost predator’ by refusing to release the Epstein client list. Your answer: ‘Simple. Because of who’s on that list,” Democratic lawmakers, led by ranking member Rep. Jamie Raskin, D-Md., wrote.

‘Now that you are the Director of the FBI, you know precisely who is implicated in the Epstein files, yet you refuse to release them. Who are you protecting and why?’

The letter pointed to several occasions where Patel called for transparency in Epstein’s case, including his statement soon after taking the role, ‘There will be no cover-ups, no missing documents, and no stone left unturned — and anyone from the prior or current Bureau who undermines this will be swiftly pursued.’

‘Strangely, all these promises appear to have collapsed once you determined who was actually in the files,’ the Democrats wrote.

They also referenced a New York Times report that detailed hundreds of people pouring over thousands of documents related to Epstein.

‘This frantic review by nearly 1,000 agents of over 100,000 pages of investigative material apparently revealed no information worthy of disclosure to the American public— however, at least some information from the review was shared with President Trump. In May, Attorney General Bondi reportedly informed President Trump that his name indeed appeared repeatedly in the Epstein files,’ the letter said.

‘Obvious questions abound: why were so many agents tasked with reviewing documents that were never released? What specific instructions were they given during the review? What information did these agents uncover that led DOJ and FBI to reverse their promise to release the files, and how are these decisions related to the President?’

President Donald Trump himself denied being told that his name was in any files related to Epstein in late July.

‘No, I was never, never briefed. No,’ the president said at the time.

It was never reported in what context Trump’s name may have appeared, however. It’s known that the two were friendly before a falling out in the early 2000s, though Trump has never been implicated in any wrongdoing related to Epstein’s crimes.

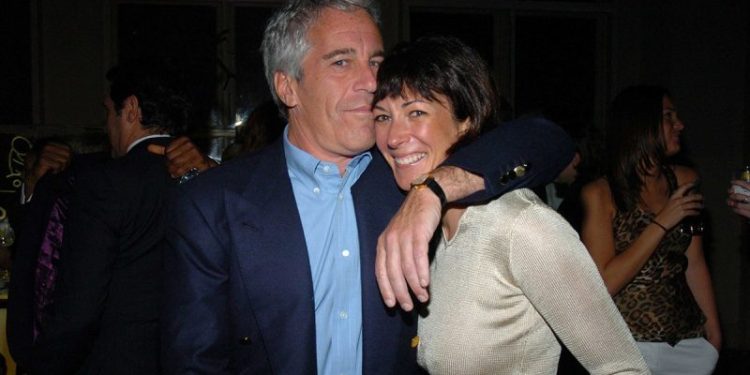

Trump himself directed the Department of Justice (DOJ) to release grand jury transcripts related to Epstein, and Attorney General Pam Bondi subsequently had her deputy interview Epstein accomplice Ghislaine Maxwell in a Florida prison.

Trump has also called the furor surrounding Epstein a ‘hoax’ on multiple occasions.

The DOJ has since turned over thousands of documents related to Epstein to the House Oversight Committee.

Convicted sex offender Epstein committed suicide in 2019 while awaiting prosecution on federal sex trafficking charges and the GOP base has fractured over the administration’s handling of the case.

The divisions stem from a DOJ memo released in July that said, ‘This systematic review revealed no incriminating ‘client list.’ There was also no credible evidence found that Epstein blackmailed prominent individuals as part of his actions. We did not uncover evidence that could predicate an investigation against uncharged third parties.’

Democrats have since seized on the discord with newfound calls for transparency in Epstein’s case, which Republicans have panned as hypocrisy.

An FBI public information officer declined to comment on the letter when the bureau was reached by Fox News Digital.