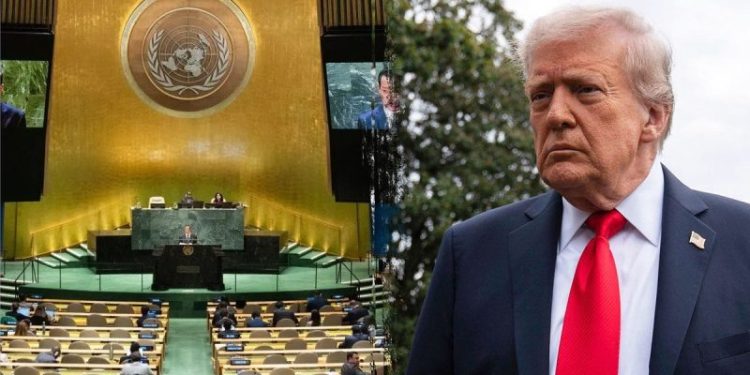

President Donald Trump will highlight the ‘return of American strength’ in his second administration during his speech at the United Nations General Assembly Tuesday, while delivering ‘blunt’ and ‘tough talk’ about the ‘failures of globalism,’ a White House official told Fox News Digital.

The president is scheduled to deliver his first address of his second administration at the UN General Assembly in New York City Tuesday just before 10 a.m.

A White House official gave Fox News Digital an exclusive preview of the president’s address.

‘President Trump has effectively restored American strength on the world stage,’ a White House official told Fox News Digital. ‘His historic speech at the United Nations General Assembly will highlight his success in delivering peace on a scale that no other president has accomplished, while simultaneously speaking bluntly about how globalist ideologies risk destroying successful nations around the world.’

The president is expected to highlight his successful efforts to negotiate peace around the world—specifically, Armenia and Azerbaijan; Thailand and Cambodia; Rwanda and the Democratic Republic of the Congo; among others.

The president is also expected to highlight his strikes against narcoterrorists from Venezuela.

Earlier this month, a U.S. military strike blew apart a Venezuelan drug boat in the southern Caribbean, leaving nearly a dozen suspected Tren de Aragua narcoterrorists dead. And last week, the president announced that the U.S. military had carried out its second kinetic strike on Venezuelan drug trafficking cartels.

Also last week, the president announced that he ordered a lethal strike on a vessel allegedly linked to a designated terrorist organization conducting narcotrafficking in the U.S. Southern Command’s area of responsibility. That strike left three narcoterrorists dead.

‘Intelligence confirmed the vessel was trafficking illicit narcotics, and was transiting along a known narcotrafficking passage en route to poison Americans,’ Trump posted to his Truth Social announcing the strike.

The president is also expected to highlight his ‘Operation Midnight Hammer,’ which marked the largest B-2 operational strike in history and represented the United States’ move to deliver a decisive blow against Iran’s nuclear program back in June.

Trump’s historic precision strikes on Iran’s nuclear sites hit their targets and ‘destroyed’ and ‘badly damaged’ the facilities’ critical infrastructure—an assessment agreed upon by Iran’s Foreign Ministry, Israel, and the United States.

Trump is also set to detail his work to ‘deliver historic peace deals in decades-long conflicts,’ the official told Fox News Digital.

Meanwhile, the president’s speech will also feature ‘some blunt, tough talk about the failures of globalism.’

‘This will include the global migration regime, energy and climate, and how these ideologies pushed by globalists are on the verge of destroying successful nations,’ a White House official told Fox News Digital.

The president is also expected to discuss America’s position as a ‘defender of western civilization.’

‘As the president delivers peace in major conflicts around the world, what has the United Nations been doing?’ the official said.

After his speech at the United Nations, the president is expected to have meetings with the Secretary-General of the United Nations, António Guterres; Ukrainian President Volodymyr Zelenskyy; the president of Argentina, Javier Milei; and the president of the European Commission, Ursula von der Leyen.

The president is also scheduled to have a multilateral meeting with leaders from Qatar, Jordan, Turkey, Pakistan, Indonesia, Egypt, the UAE and Saudi Arabia.