Introduction:

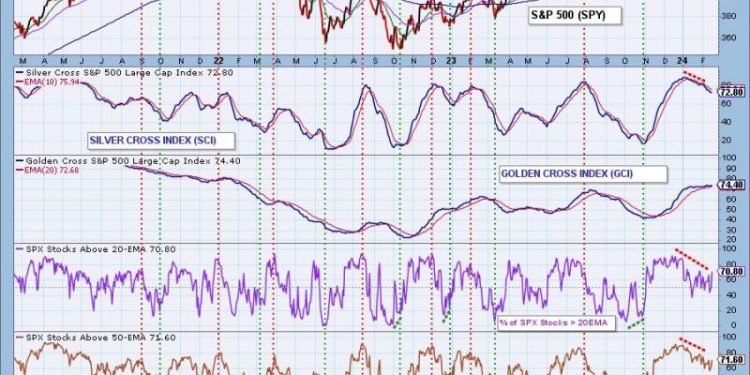

In the unpredictable world of investing, it is crucial to closely monitor market trends and signals in order to make sound investment decisions. One key aspect of successful investing is recognizing and understanding buy signals, which can provide investors with an indication of opportune moments to enter the market. However, recent shifts in the investment landscape have painted a rather gloomy picture for buyers. The dwindling number of buy signals is a cause for concern, signaling potential challenges ahead for investors seeking profitable opportunities.

1. Economic Uncertainty:

The global economy remains fragile due to ongoing geopolitical tensions, the impact of the COVID-19 pandemic, and other factors. Such uncertainty has made investors wary, leading to a decrease in buy signals. Economic indicators, such as declining GDP growth rates, inflationary pressures, and stagnant wage growth, contribute to the overall skepticism among market participants. In such an environment, investors are hesitant to take risks and are unlikely to receive bullish signals to enter the market.

2. Market Saturation:

Across various sectors, markets have experienced significant growth and experienced saturation. Traditional industries, such as energy, telecommunications, and retail, have faced intense competition with limited room for newcomers. As a result, relative scarcity of buy signals has become all too common. Investors find it increasingly difficult to identify emerging companies or industries with growth potential. This saturation leads to a decreased number of attractive investment opportunities and further diminishes the occurrence of buy signals.

3. Valuation Concerns:

The hike in stock prices and sky-high valuations of certain companies raise concerns among investors. The increasing number of overvalued stocks results in a lack of confidence in the market’s long-term sustainability. Investors are less willing to purchase stocks at inflated prices due to the risk of future correction or collapse. Furthermore, valuation metrics such as price-to-earnings ratios and price-to-sales ratios have reached historically high levels, making attractive buy signals even harder to come by.

4. Central Bank Intervention:

Central banks play a crucial role in shaping market dynamics through monetary policy decisions. However, the persistent low-interest-rate environment adopted by central banks worldwide has unintended consequences. While low interest rates stimulate economic growth, they lead to inflated asset prices, including stocks, bonds, and real estate. Subsequently, investors are prompted to exercise greater caution, as the prolonged intervention of central banks distorts the natural balance of supply and demand signals within the market.

5. Technological Disruption:

The rapid advancement of technology has disrupted traditional business models across industries. This shift has forced investors to be more discerning when identifying buy signals, as new players emerge and established ones struggle to adapt. The evolving landscape complicates investment decisions, resulting in fewer clear buy signals. Investors must navigate through sectors affected by technological innovations, such as automation, artificial intelligence, and distributed ledger technologies, in order to find attractive opportunities.

Conclusion:

The diminishing presence of buy signals poses a significant challenge for investors. Economic uncertainty, market saturation, valuation concerns, central bank interventions, and technological disruptions have collectively contributed to a decline in buy signals. In such an environment, conducting thorough research, diversified portfolio management, and seeking professional advice become increasingly important. Investors need to exercise caution and remain vigilant in order to identify potential opportunities amidst the diminishing buy signals. While the investment landscape may appear bleak, adaptive strategies and an informed approach can still yield profitable returns in the face of an evolving market.