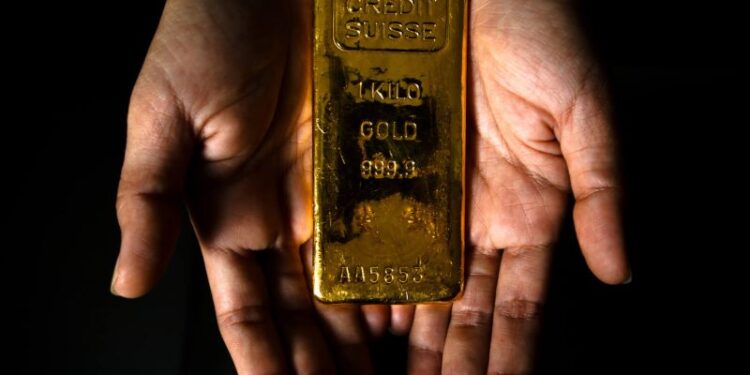

Seasonality is undoubtedly a powerful driver in the markets, but it is often said to be overblown. After all, over the long-term, underlying fundamentals will always reign supreme. That is why investors have been carefully watching the convergence between the two in recent months when it comes to the gold ETF, GLD.

GLD, the physically-backed SPDR Gold Shares ETF, has been hovering near an all-time high for the last few weeks, and periodical seasonal trends have played a part in this. Some investors have used seasonality to develop theories that years ending with the number ‘5’ tend to be better for gold prices than years ending ‘4’. While this might be anecdotal, it is something that has acquired a lot of traction in recent times.

On the other hand, one cannot escape the fact that strong macroeconomic fundamentals have also been at play. The U.S. dollar has remained weak over the first few months of 2020, and demand for gold has remained high. This has been attributed to the recent surge in buying by central banks, especially in emerging markets. India, Russia, and China have been significant buyers of gold as a hedge for the weak dollar and has likely added support for GLD.

The less robust U.S. dollar has also benefited gold prices, leading to its remarkable rise in 2020. Central banks around the world have turned to more dovish monetary policy, including sending interest rates below zero. This has done little to support the U.S. dollar, and the current climate of low interest rates looks set to prevail for some time.

Therefore, it appears the trend of seasonality and fundamentals converging on GLD is likely to continue. Although seasonality may not always align with fundamentals completely, the current situation looks to be golden for gold buyers. It looks as if nothing can break the momentum in gold prices either through seasonality or through underlying macroeconomic fundamentals. It looks like investors can be sure that buying GLD now is a strong bet for both the short-term, and the long-term.