Relative Strength and Other Measures in Rules-Based Money Management

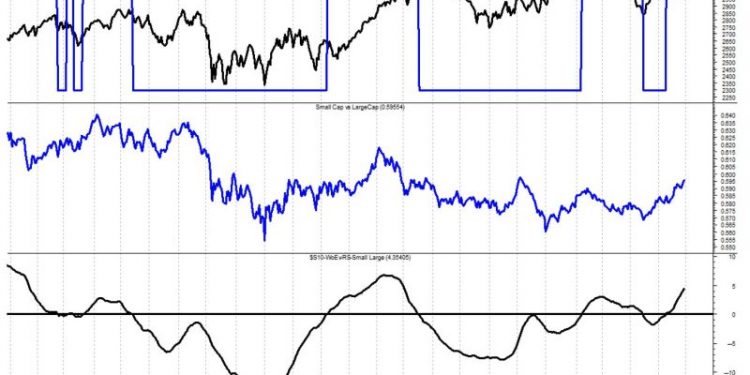

In the realm of rules-based money management, applying relative strength and other measures can significantly enhance one’s investment strategies. Relative strength is a powerful concept that focuses on analyzing the performance of an asset relative to other assets. This metric helps investors identify securities that are outperforming or underperforming their peers, enabling them to make informed decisions based on this comparative analysis.

One of the key advantages of relative strength is its ability to provide a clear picture of which assets are demonstrating strong performance compared to others in the same category. By examining the relative strengths of various securities, investors can pinpoint opportunities for buying or selling based on the premise that assets showing relative strength are likely to continue their positive momentum while those exhibiting weakness may face further declines.

Moreover, relative strength can be utilized in conjunction with other technical indicators to refine investment decisions further. For example, combining relative strength analysis with trend-following indicators such as moving averages can validate potential trading signals and confirm the overall market sentiment towards a particular asset.

In addition to relative strength, there are several other measures that investors can incorporate into their rules-based money management toolkit. One such measure is volatility, which quantifies the degree of price fluctuation in an asset. Understanding volatility is critical as it helps investors gauge the risk associated with a particular security and adjust their investment approach accordingly.

Another important measure is correlation, which assesses the relationship between two assets and how they move in relation to each other. By diversifying a portfolio with assets that have low correlation, investors can reduce overall risk and potentially enhance returns through improved risk-adjusted performance.

Furthermore, investors can employ measures such as momentum indicators, moving averages, and volume analysis to refine their decision-making process and identify potential trading opportunities. These measures, when used in conjunction with relative strength analysis, can provide a comprehensive view of the market environment and aid in making well-informed investment choices.

Overall, integrating relative strength and other measures into rules-based money management strategies can offer investors a structured framework for navigating the complexities of financial markets. By leveraging these tools effectively, investors can enhance their ability to identify profitable opportunities, manage risk more effectively, and achieve their long-term financial objectives.