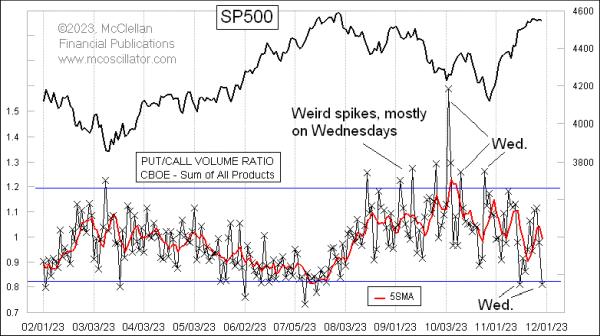

Weird Wednesdays are an exciting new trend in investing that’s been gaining traction amongst savvy investors. The concept involves selecting stocks or other investments with a Put/Call Ratio (PCR) of higher than 1.0. Put/Call Ratio is a measure of trading activity which tells investors how many traders are buying (put option) relative to the number of traders selling (call option). A ratio higher than 1.0 indicates that more traders are buying the asset and therefore suggests that the asset may be experiencing an increase in demand due to bullish sentiment in the market.

Put/Call Ratio is an important metric to use in order to gauge the volume and ultimately the direction of the stock. Professional investors have long used the PCR as one tool to find profitable investments. However, not all stocks with a PCR higher than 1.0 will go up. This is where Weird Wednesdays come into play.

Weird Wednesdays involve selecting stocks with a PCR of higher than 1.0 and waiting for the stock’s price to rise over the course of the trading day. The idea is to buy low, sell high and make a profit quickly. This strategy is ideally suited for day traders who want to take advantage of short-term price fluctuations and can be especially lucrative on days of high volatility.

Many investors use PCRs in combination with other metrics to help them identify potential trends in the market. Others devote an entire trading day to Weird Wednesdays and will focus exclusively on stocks with a PCR higher than 1.0. It’s important to remember that correctly interpreting a PCR takes a little bit of experience so it’s important to become familiar with the metric before jumping in to capitalize on Weird Wednesdays.