Secular Markets: Understanding the Long-Term Trends

Secular markets are a key concept in finance that refers to the long-term trends in the financial markets. These trends can last for decades and are characterized by consistent patterns of growth or decline. Understanding secular markets is crucial for investors and analysts as it provides insights into the broader economic landscape and helps in making informed investment decisions.

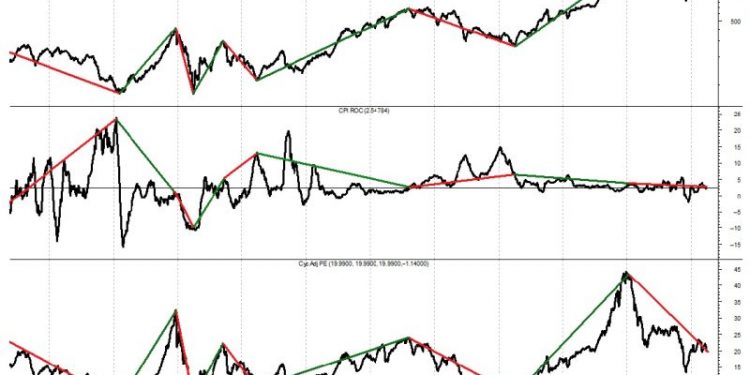

One of the defining features of secular markets is the long duration over which they occur. Unlike cyclical markets, which tend to last for shorter periods, secular markets can span several decades. During a secular bull market, asset prices generally rise over an extended period, driven by positive economic conditions, technological advancements, and other factors.

Conversely, in a secular bear market, asset prices experience an extended period of decline. These periods are often characterized by economic downturns, recessions, and other negative factors that weigh on market sentiment. Secular bear markets can be challenging for investors, as they require a long-term perspective and the ability to withstand periods of volatility and uncertainty.

Secular markets can be influenced by a wide range of factors, including economic growth, inflation, interest rates, technological innovation, and geopolitical events. These factors can shape market trends and drive asset prices in a particular direction for an extended period. By analyzing these factors, investors can gain a better understanding of the underlying forces driving secular market trends and adjust their investment strategies accordingly.

It is essential for investors to recognize that secular markets are not always straightforward and can be subject to reversals and corrections along the way. While a secular trend may persist for several years, it is not immune to short-term fluctuations and market cycles. Therefore, it is important to adopt a balanced approach to investing that takes into account both long-term trends and short-term market dynamics.

In conclusion, secular markets play a significant role in shaping the financial landscape and can have a profound impact on investment outcomes. By understanding the long-term trends in the markets and the factors driving them, investors can make more informed decisions and navigate the complexities of the financial world with greater confidence and resilience.