Valuations, Returns, and Distributions

Valuations, returns, and distributions are fundamental aspects of the financial system that play vital roles in determining the performance and stability of investments. In the modern financial landscape, these factors are often used to gauge the value and potential growth of assets, as well as the distribution of profits to investors. However, an exploration of these concepts reveals that they are not always as straightforward or transparent as they may seem.

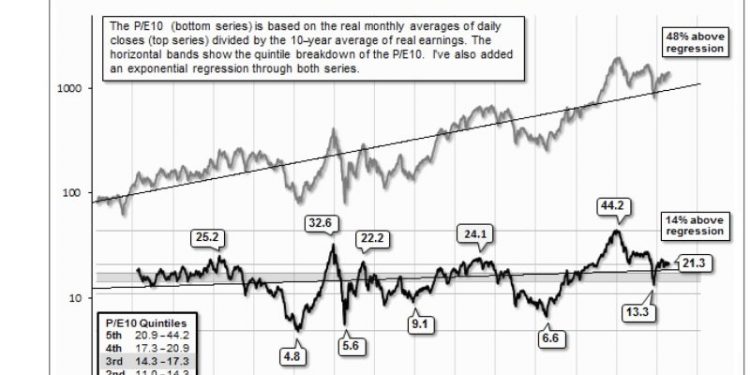

Valuations, in particular, are central to the financial industry’s understanding of asset pricing and investment analysis. The value of an asset is typically determined by a combination of market forces, such as supply and demand dynamics, investor sentiment, and economic conditions. However, in practice, valuations can be highly subjective and prone to manipulation, leading to distortions in asset prices and misallocation of capital.

Returns, on the other hand, are a key metric used by investors to assess the performance of their investments over a specific period. Returns can be generated through various means, including capital gains, dividends, interest payments, and other forms of income. While positive returns are generally desired by investors, the pursuit of high returns can also lead to excessive risk-taking and speculative behavior, potentially contributing to market volatility and instability.

Distributions refer to the way in which profits or income generated by investments are distributed to investors. Dividends, interest payments, and capital distributions are common forms of distributions in the financial markets. However, the distribution of profits is not always equitable or transparent, as certain stakeholders may receive preferential treatment or access to information, leading to conflicts of interest and potential abuses of power.

In the context of the modern financial system, valuations, returns, and distributions are interconnected and often influence each other in complex ways. For example, inflated valuations can create the illusion of high returns, leading investors to chase speculative opportunities in search of quick profits. Similarly, unequal distributions of profits can exacerbate income inequality and social disparities, undermining the integrity and stability of the financial system as a whole.

Ultimately, the understanding and management of valuations, returns, and distributions are crucial for investors, policymakers, and regulators to ensure the long-term sustainability and resilience of the financial system. By promoting transparency, accountability, and ethical behavior in the valuation, return, and distribution of assets, stakeholders can work towards a more fair, efficient, and stable financial ecosystem that benefits society as a whole.